Falcon Oil & Gas Ltd.

(“Falcon” or “Company”)

Shenandoah South-1H well IP90 Day Flow Rates of 2.9 MMcf/d (normalised to 5.8 MMcf/d)

26 April 2024 – Falcon Oil & Gas Ltd. (TSXV: FO, AIM: FOG) is pleased to announce that the Shenandoah South 1H (SS-1H) well in EP117 achieved above commercial IP90 flow rate of 2.9 MMcf/d (normalised to 5.8 MMcf/d over 1,000 metres).

Highlights are as follows:

- The SS-1H well in EP117 achieved an average 90-day initial production (IP90) flow rate of 2.9 million cubic feet per day (MMcf/d) over the 1,644-foot (501 metres), 10 stage stimulated length within the Amungee Member B-Shale, normalised to 5.8 MMcf/d over 3,281-feet (1,000 metres).

- On completion of the IP90 flow test, the well was delivering 2.7 MMcf/d, normalized to 5.4 MMcf/d over 3,281-feet (1,000 metres) at a pressure of 518 psi prior to being shut-in.

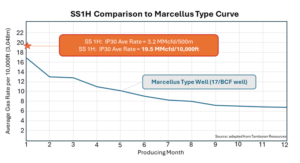

- The SS-1H flow test indicates that future development wells with lateral lengths of 10,000 feet may be capable of delivering average rates of 17.8 MMcf/d over the first 90 days of production.

- The SS-1H well has demonstrated steady gas flows and decline profiles in line with some of the most prolific regions of the Marcellus Shale in the US.

- The well will now be shut in and suspended as a potential future production well.

- The Beetaloo Joint Venture Partners (BJV) of Falcon Australia and Tamboran B2 Pty Limited will continue to undertake Front End Engineering and Design (FEED) studies on the proposed Shenandoah South Pilot Project. The Company expects to take Final Investment Decision (FID) in mid-2024, subject to funding and key stakeholder approvals.

- The strong SS-1H result has further validated the decision to progress with the pilot project in the Shenandoah South region within the deep shale in the Beetaloo West . The 1 million acres of deep shale in the Beetaloo West, at a similar depth to SS-1H, has the potential to deliver the BJV’s production ambition of 2 Bcf/d (equivalent to more than 13.0 million tonnes per annum of LNG export capacity) for 40 years from a single landing zone.

- At the end of March 2024, Falcon held ~US$4.3 million in cash, US$4.9m was raised in April 2024 as part of an equity raise and US$4m for the sale of overriding royalty interests (ORRIs). Falcon Australia also has the benefit of a net carry of a further US$2.5 million.

- Falcon is now fully funded for it’s share of the drilling and testing of the initial two wells in the program together with the acquisition and processing of the proposed 3D programme (330km2).

Philip O’Quigley, CEO of Falcon commented:

“The SS-1H IP90 flow rate announced today of 2.9 MMcf/d, normalised to 5.8 MMcf/d over 1,000 metres, demonstrates a steady low declining curve while holding its downhole pressure. This augurs well for the initial development in the Shenandoah South area as these rates continue to track average flow rates seen in the Marcellus Shale basin in the US.”

Table 1: Breakdown of the SS-1H flow result

| Rates (MMcf/d) | Actual (501m, 1,644 ft) |

Normalized (1,000m, 3,281 ft) |

Normalized (10,000 ft) |

| Peak rate | 12.9 | N/A | N/A |

| Average IP30 flow rate | 3.2 | 6.4 | 19.5 |

| IP30 exit rate | 2.9 | 5.8 | 17.6 |

| Average IP60 flow rate | 3.0 | 6.0 | 18.4 |

| IP60 exit rate | 2.8 | 5.5 | 16.8 |

| Average IP90 flow rate | 2.9 | 5.8 | 17.8 |

| IP90 exit rate | 2.7 | 5.4 | 16.4 |

Source: Tamboran

Ends.

CONTACT DETAILS:

| Falcon Oil & Gas Ltd. | +353 1 676 8702 |

| Philip O’Quigley, CEO | +353 87 814 7042 |

| Anne Flynn, CFO | +353 1 676 9162 |

| Cavendish Capital Markets Limited (NOMAD & Joint Broker) | |

| Neil McDonald / Adam Rae |

+44 131 220 9771 |

| Tennyson Securities (Joint Broker) | |

| Peter Krens |

+44 20 7186 9033 |

This announcement has been reviewed by Dr. Gábor Bada, Falcon Oil & Gas Ltd’s Technical Advisor. Dr. Bada obtained his geology degree at the Eötvös L. University in Budapest, Hungary and his PhD at the Vrije Universiteit Amsterdam, the Netherlands. He is a member of AAPG.

About Falcon Oil & Gas Ltd.

Falcon Oil & Gas Ltd is an international oil & gas company engaged in the exploration and development of unconventional oil and gas assets, with the current portfolio focused in Australia. Falcon Oil & Gas Ltd is incorporated in British Columbia, Canada and headquartered in Dublin, Ireland..

Falcon Oil & Gas Australia Limited is a c. 98% subsidiary of Falcon Oil & Gas Ltd.

For further information on Falcon Oil & Gas Ltd. Please visit www.falconoilandgas.com

About Beetaloo Joint Venture (“BJV”) (EP 76, 98 and 117)

EP 98/117 interests

| Company | Interest |

| Tamboran (B2) Pty Limited | 77.5% |

| Falcon Oil & Gas Australia Limited (Falcon Australia) | 22.5% |

| Total | 100.0% |

Shenandoah South-1 DSU – 20,480 acres

| Company | Interest |

| Tamboran (B2) Pty Limited | 77.5% |

| Falcon Oil & Gas Australia Limited (Falcon Australia) | 22.5% |

| Total | 100.0% |

Shenandoah South-2 DSU – 51,200 acres

| Company | Interest |

| Tamboran (B2) Pty Limited | 95.0% |

| Falcon Oil & Gas Australia Limited (Falcon Australia) | 5.0% |

| Total | 100.0% |

About Tamboran (B2) Pty Limited

Tamboran (B1) Pty Limited (“Tamboran B1”) is the 100% holder of Tamboran (B2) Pty Limited, with Tamboran B1 being a 50:50 joint venture between Tamboran Resources Limited and Daly Waters Energy, LP.

Tamboran Resources Limited, is a natural gas company listed on the ASX (TBN) and U.S. OTC markets (TBNNY). Tamboran is focused on playing a constructive role in the global energy transition towards a lower carbon future, by developing the significant low CO2 gas resource within the Beetaloo Basin through cutting-edge drilling and completion design technology as well as management’s experience in successfully commercialising unconventional shale in North America.

Bryan Sheffield of Daly Waters Energy, LP is a highly successful investor and has made significant returns in the US unconventional energy sector in the past. He was Founder of Parsley Energy Inc. (“PE”), an independent unconventional oil and gas producer in the Permian Basin, Texas and previously served as its Chairman and CEO. PE was acquired for over US$7 billion by Pioneer Natural Resources Company (“Pioneer”), itself a leading independent oil and gas company and with the PE acquisition became a Permian pure play company. Pioneer has a current market capitalisation of c. US$60 billion.

Advisory regarding forward looking statements

Certain information in this press release may constitute forward-looking information. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking information. Forward-looking information typically contains statements with words such as “may”, “will”, “should”, “expect”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “projects”, “dependent”, “consider” “potential”, “scheduled”, “forecast”, “outlook”, “budget”, “hope”, “suggest”, “support” “planned”, “approximately”, “potential” or the negative of those terms or similar words suggesting future outcomes. In particular, forward-looking information in this press release includes, but is not limited to, information relating to the SS-1H well in EP117 achieving an average IP90 flow rate of 2.9 MMcf/d over the 1,644-foot (501 metres), 10 stage stimulated length within the Amungee Member B-Shale, normalised to 5.8 MMcf/d over 3,281-feet (1,000 metres), the well delivering 2.7 MMcf/d, normalized to 5.4 MMcf/d over 3,281-feet (1,000 metres) on completion at a pressure of 518 psi prior to being shut-in, indicators that future development wells with lateral lengths of 10,000 feet may be capable of delivering average rates of 17.8 MMcf/d over the first 90 days of production, SS-1H results being in line with some of the most prolific regions of the Marcellus Shale in the US, the well being shut in and suspended as a potential future production well, the BJV continuing to undertake FEED studies on the proposed Shenandoah South Pilot Project, the FID to be taken in mid-2024, subject to funding and key stakeholder approvals, the strong SS-1H result further validating the decision to progress with the pilot project in the Shenandoah South region within the deep shale in the Beetaloo West . The 1 million acres of deep shale in the Beetaloo West, at a similar depth to SS-1H, having the potential to deliver the BJV’s production ambition of 2 Bcf/d (equivalent to more than 13.0 million tonnes per annum of LNG export capacity) for 40 years from a single landing zone, funding for it’s share of the drilling and testing of the initial two wells in the program together with the acquisition and processing of the proposed 3D programme (330km2).

This information is based on current expectations that are subject to significant risks and uncertainties that are difficult to predict. The risks, assumptions and other factors that could influence actual results include risks associated with fluctuations in market prices for shale gas; risks related to the exploration, development and production of shale gas reserves; general economic, market and business conditions; substantial capital requirements; uncertainties inherent in estimating quantities of reserves and resources; extent of, and cost of compliance with, government laws and regulations and the effect of changes in such laws and regulations; the need to obtain regulatory approvals before development commences; environmental risks and hazards and the cost of compliance with environmental regulations; aboriginal claims; inherent risks and hazards with operations such as mechanical or pipe failure, cratering and other dangerous conditions; potential cost overruns, drilling wells is speculative, often involving significant costs that may be more than estimated and may not result in any discoveries; variations in foreign exchange rates; competition for capital, equipment, new leases, pipeline capacity and skilled personnel; the failure of the holder of licenses, leases and permits to meet requirements of such; changes in royalty regimes; failure to accurately estimate abandonment and reclamation costs; inaccurate estimates and assumptions by management and their joint venture partners; effectiveness of internal controls; the potential lack of available drilling equipment; failure to obtain or keep key personnel; title deficiencies; geo-political risks; and risk of litigation.

Readers are cautioned that the foregoing list of important factors is not exhaustive and that these factors and risks are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. Falcon assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to Falcon. Additional information identifying risks and uncertainties is contained in Falcon’s filings with the Canadian securities regulators, which filings are available at www.sedarplus.com, including under “Risk Factors” in the Annual Information Form.

Any references in this news release to initial production rates are useful in confirming the presence of hydrocarbons; however, such rates are not determinative of the rates at which such wells will continue production and decline thereafter and are not necessarily indicative of long-term performance or ultimate recovery. While encouraging, readers are cautioned not to place reliance on such rates in calculating the aggregate production for Falcon. Such rates are based on field estimates and may be based on limited data available at this time.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.